With the holiday season upon us, the Canadian government has announced a measure designed to ease the financial burden on Canadians. Prime Minister Justin Trudeau unveiled a temporary initiative to suspend the Goods and Services Tax (GST) on the following product categories:

- Children’s clothing;

- Children’s shoes;

- Children’s diapers;

- Car seats;

- Printed newspapers;

- Printed books;

- Christmas trees or similar decorative trees;

- Certain foods and beverages;

- Certain children’s toys;

- Puzzles;

- Video game consoles, controllers or physical game media.

This measure, which will be effective from December 14, 2024 to February 15, 2025, will, among other things, offer relief to consumers during this period of increased spending. For merchants, however, this initiative may represent a challenge. Adapting quickly to this tax change, communicating effectively with customers and showcasing the products concerned are crucial to maximizing the positive impact on their sales. Novatize has a team of specialists ready to support merchants in the temporary process of changing item prices.

If you’d like to learn more about the GST holiday break initiative, refer to the federal government website.

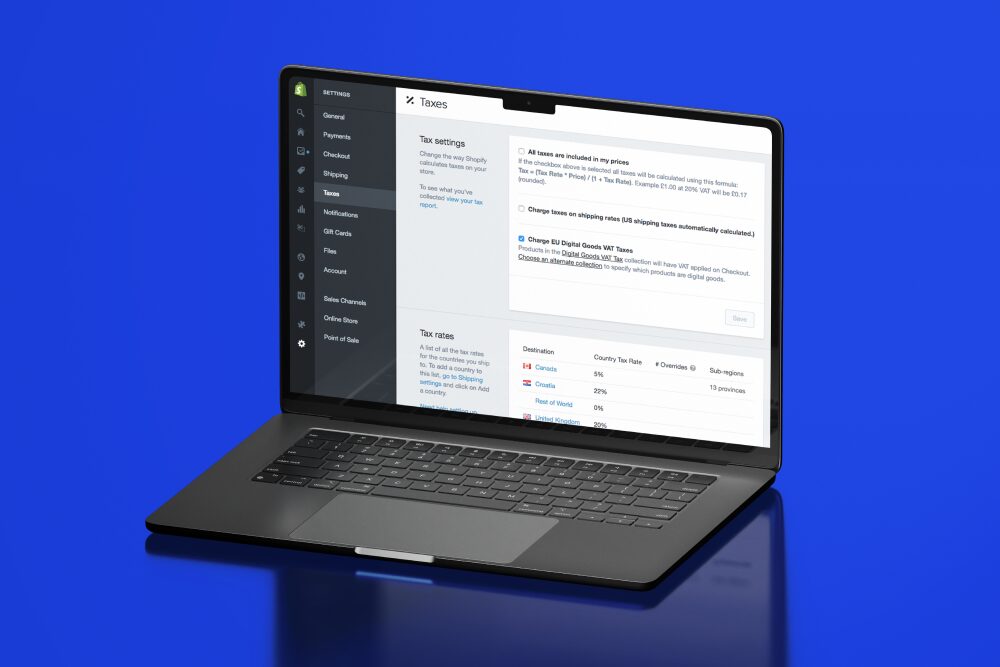

How do you adapt your eCommerce on Shopify?

For merchants using Shopify for their eCommerce, the platform usually automatically calculates taxes based on your location and applicable tax laws. However, it is possible to modify these rates to better meet the specific needs of your business. In this case, in response to the temporary suspension of the GST.

To set up GST exemption on your Shopify platform, follow these steps:

1. Access tax settings

- In your administrator dashboard, click on “Settings” (bottom left)

- Select “Taxes and Duties” from the menu

- Select “Canada region”

2. Set up GST exemption

- Scroll down to “Tax overrides and exemptions”

- In the “Product overrides” section, click on “Add tax override”

3. Configure override

- Create a collection of products requiring GST exemption

- If you don’t already have a collection, go to “Products” then “Collections” and create one

- Select “Canada”

- Set the GST rate to 0%

- Click on “Add override”

4. Check the exemption

- Go back to “Products” and check a product in the collection to confirm that the new tax rate applies at checkout

- After a few sales to your customers during the holiday season, check your tax reports in “Analytics” then “Reports” to confirm that the correct tax amounts are being collected

Also, to avoid confusion, add descriptions or an informative banner on your site to indicate that the federal tax only applies to certain items during the period from December 14, 2024 to February 15, 2025. Finally, carry out several tests in your shopping cart to ensure that your customer experience remains fluid and compliant with regulations.

For more information, refer directly to the Shopify website or reach out to our specialists to assist you.

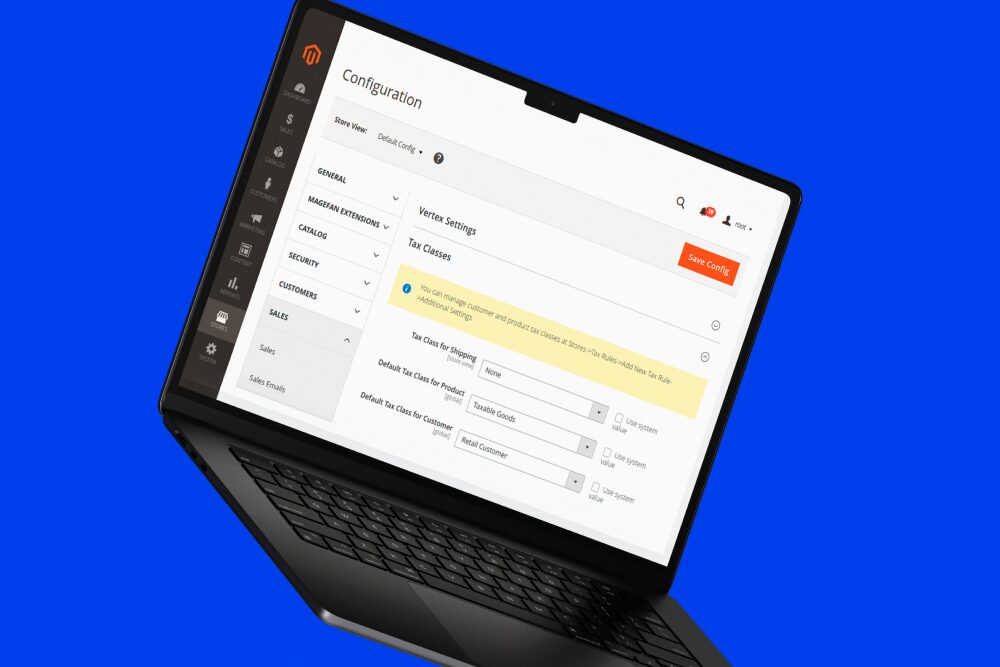

How do you adapt your eCommerce on Adobe Commerce (Magento)?

For retailers using Adobe Commerce (Magento), here are the steps you need to take to obtain a temporary GST exemption in Canada:

1. Access the tax rate configuration:

- Go to “Stores”, then “Tax Zones and Rates”

- Click on “Add New Tax Rate”

2. Set the new tax rate to 0%:

- Give a descriptive name, for example, “GST Exempt (0%)”

- Select “Canada”

- Select “All Regions”

- Leave a “*” to cover all postal codes or specify a range if necessary

- Enter 0.0000 for the rate

3. Associate the new rate with a tax rule:

- Go to “Stores” then “Tax Rules” and create a new rule

- Configure the rule as follows:

- Name: “GST Exemption (Dec. 14 – Feb. 15)”

- Rate: Select your new rate “GST Exempt (0%)”

- In the advanced settings, select or create a new class or select the one already in use for the categories concerned

4. Associate the rule with the products concerned:

- You can use the product grid to filter and update products in bulk:

- Access the product list and go to “Catalog” and “Products”

- Filter by category:

- In the filter field, select the relevant category:

- Click on “Filters”

- Select the category in the “Category” filter and apply it

- In the filter field, select the relevant category:

- Select all filtered products and click on the checkbox in the header to select all displayed products

- Mass update :

- In the “Actions” drop-down menu, select “Update Attributes”

- Find the “Tax Class” attribute and set it to “GST Exemption (0%)”

- Click on “Save” to apply the changes

5. Test the configuration:

- Add a product from the relevant categories to the shopping cart

- Check that GST is not applied

Also, like Shopify merchants, be sure to update descriptions or add an informative banner on your eCommerce to clearly communicate which products are affected by the tax exemption. Finally, test your shopping cart to confirm that GST is correctly removed for affected products and to ensure a consistent user experience.

If you’d like to find out more, go directly to the Adobe Commerce website, or reach out to our specialists to support you.

The temporary suspension of the GST in Canada represents an opportunity for online merchants to meet the needs of consumers while demonstrating their ability to adapt. Whether you’re using Shopify or Adobe Commerce (Magento), it’s essential to quickly adjust your tax settings to reflect this exemption and avoid any confusion with your customers. Precise configuration of tax waivers or exemption rules not only ensures regulatory compliance, but also a smooth shopping experience. By proactively adapting your eCommerce platforms, you can maximize the benefits of this measure for your customers, and for your online business this holiday season.

Do you need fast support to be ready when the GST exemption comes into effect?

📞 +1 844 932 6682

📍 330-330 Saint-Vallier Est Street, G1K 9C5, Québec, QC, Canada

Inspired by what you’ve read?

Our team of experts can help you take your eCommerce to the next level!